In recent years, technological advancement has been congruent with the digital finance industry, creating a new era by changing the way financial services are rolled out, used and managed. The more powerful feature of this financial technology transformation is that it is not just a trend in restructuring the platform, but a complete difference in the paradigm of the industry. The utilization of cutting-edge technologies serves as a stamp of differentiating fintech from the classic banking methods. Employing new methods, such as mobile applications and digital wallets, fintech is reshaping the sphere of financial services, empowering individuals and organizations as well.

Innovation in Finance

The financial services sector typically is a by-product of a complex process, a governed environment, and antiquated systems. While the traditional financial system has always existed as a challenge to the unbanked population, technology known as fintech, seems to be a mighty weapon, and it is deconstructing these boundaries. Fintech startups leverage powerful disruptive tools such as artificial intelligence (AI), blockchain, as well as data analytics, to optimize processes, create friendly customer experience, and increase the number of people joining the financial society. One example of fintech innovation is alternative investment platforms, and WallStreetZen shares how it works by reviewing companies like Masterworks, which allow investors to participate in fractional art investing.

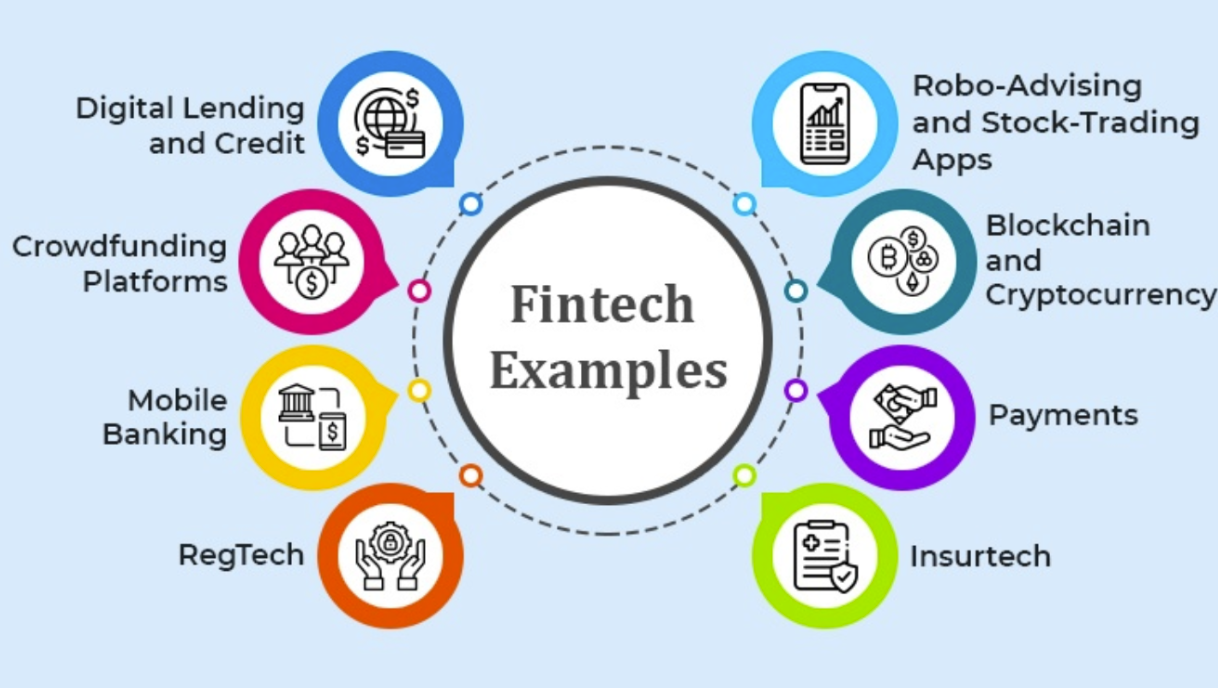

Fintech Solutions

Technological progress provides an important impetuous for the fintech revolution due to sophisticated financial services software. An illustration of these platforms is transactions that are openly done in a seamless manner, analysis done in real time, and recommendations decided by the user’s preferences; these enlighten the user to steer his/her financial life in the exact direction he/she wants. With the use of user customizable solutions, business deals with specific needs issue and optimize processes efficiency as well as effectiveness for particular cases. These advancements are not confined to a single market but are significantly shaping financial landscapes globally. For instance, keeping track of specific regional developments, such as finance trends in Sweden, can provide valuable insights into localized innovation and adoption rates.

From mobile apps for online payments to investment platforms, finance tech (Fintech) solutions meet the unique requirements of a spectrum of customers, hence users now enjoy a propitious online financial world. For instance, the peer-to-peer lending platforms combine borrowers with investors taking banks, financial institutions, and even other intermediaries out of the equation and helping to offer the borrowers better rates. And all it takes to secure enough investments for your startup is to create, launch and promote Kickstarter campaigns. Then, robo-advisors take advantage of all the AI features to give individualized investment advice to make the wealth management product available even to those who could not afford it in the past.

Institutional asset managers are also using fintech to open up alternative, longevity-based investments once limited to specialists. As an institutional asset manager, Abacus applies underwriting analytics, automation, and modern investor portals to manage life-expectancy risk and deliver lifespan-driven financial solutions—demonstrating how data and technology can scale access, improve transparency, and align investment products with the realities of human longevity.

Beyond lending and investment advice, fintech is also transforming how private companies understand and manage their own value. Traditional valuations are slow, expensive, and often outdated by the time they’re delivered. Platforms like Eqvista’s Real-Time Company Valuation flip that model by giving founders and CFOs instant, NACVA-certified valuations they can actually act on, whether it’s raising capital, issuing ESOPs, or planning M&A. With real-time data and expert-backed insights, companies no longer have to guess their worth or wait months for a report.

AI-driven Insights

Artificial intelligence is becoming a game changer in the financial industry, albeit by offering meaningful insight and foresight. Machine learning algorithms work across gigantic repositories of data in order to learn, understand, see trends, discover patterns and prevent risks. In the field of detection of fraud to an investment strategy, AI in banking solutions are quite fast and accurate. These solutions help companies in the world of investment to make educated and real-time decisions.

It would be to exploit AI-driven insights in this way that financial institutions are brought about an opportunity to optimize operations, minimize risks, and improve the quality of the customer experience. Similarly, a bank will use predictive analytics to create personalized product recommendations for its customers which are peculiar to the customers’ tastes and patterns of behavior. Insurance agencies apply AI to the evaluation of risk profiles and craft plans individually in order to enhance underwriting precision and recognize claim fraud.

Digital Banking and Mobile Applications

According to the fact that the digital banking area and numerous mobile apps are accessed by anyone, particularly by groups of people who were deprived of financial services before. With a mobile phone and WiFi connection, people can open and manage a lot of things like accounts, to move money and make investments from any part of the world. These platforms have made complex products like mutual funds and insurance easy to understand. User-friendliness and intuitive design have made them accessible to people of various backgrounds, globally increasing the financial inclusion rate.

On the other hand, there are mobile app projects which typically include features such as budgeting tools, expense tracking, and real-time notifications making users make proper financial decisions. Through the availability of banking services on the go, digital financial applications provide people with greater convenience, and in fact, this technology has almost evolved into an entirely new way in which people deal with their money.

Regulatory Technology

Regulatory technology is commonly known as regtech. Regtech in finance especially takes a great part in making the financial sector as the players are greatly aware and compliant to the risks and violations while it has been mitigated. Via regulation robotics tools firms are capable of creating automated regulatory processes, monitoring transactions, and detecting a breach of existing rules, the firms are capable of responding to regulatory requirements in a timely manner. It is a factor that contributes to the transparency and accountability of a regulatory regime while at the same time reducing compliance costs and improving regulatory outcomes.

AML software applies machine learning algorithms to identify transaction patterns and detect suspicious activities giving financial institutions the venus to help meet their regulatory obligations and combat financial crime. Payment screening solutions against fraud enhance these efforts by specifically targeting fraudulent transactions, adding another layer of protection for both businesses and consumers. Correspondingly, KYC applications do remove the bureaucratic barriers of client onboarding by checking their identities and combat fraud at the same time. For example, investor onboarding solutions now integrate automated processes to verify identity and ensure compliance with anti-money laundering (AML) regulations.

Applying Innovation in Composing Future of Financial Services

Innovation in financial matters goes well beyond convenience and speed. It can lead to the make-over of whole economies, promote economic development, and maintain financial stability. Financial institutions are able to capitalize decentralized systems and through platforms, they open a new gate for empowering individuals.

The decentralized finance (DeFi) projects built on blockchain technology lay the ground for a financial future that is disintermediated and provides equal access to financial services to everybody without the need for a formal structure. From distributed exchanges to addition of lending protocols, DeFi ecosystems complete a full picture that allows users to trade, invest and generate yields in a completely trustless way, revolutionizing traditional finance at one go.

Conclusion

On the brink of a new era of financial services, all of us see the future of fintech clearly and know that it is here to stay. If the financial services accept the new technologies as a norm, they will enhance growth in many sectors and will also provide better experiences for the customer. As the market in which we operate is constantly evolving, companies have to move with time and synchronize with the continuously changing consumer preferences, implement innovative solutions and make digital transformation a priority.

For tech enthusiasts who want to engage in fintech development and join the revolution with disruptive fintech solutions, finance software development is a great way to get to know valuable expertise and obtain the necessary competence.

Published: May 8, 2024